Retirement is certainly not so much a matter of rich or poor, but many retirees are worried about having too little money or running out of money. The key to lasting financial peace is to invest for retirees in a way that creates a sustainable source of income while retaining capital. Here are the best investments for retirees in the UK to make sure you have a safe retirement.

How to Choose the Right Investments

What investment is best for retirees is a question that is highly dependent on your financial goal, risk profile and income needs. Things to remember:

Risk Appetite: Consider just how much risk you are willing to take. Bonds and annuities may be better suited than stocks for somebody who likes stability.

How Much Income You Need: Determine what you will need in terms of regular income to sustain your daily life. Stocks that pay dividends and rental properties can provide a steady flow of income.

Investment Horizon: Consider how long you plan to leave your money invested. You’ll want more liquid assets for short-term needs, and long-term investments can be riskier.

Diversification: Reduces risk and improves stability by spreading investments across different asset classes.

Tax Efficiency: Use tax-efficient vehicles like ISAs and pensions to ensure returns on your investment.

Dividend-paying stocks: FTSE 100 firms

One of the best investment options for retirees is owning high-yield stocks. In the UK, Companies in the FTSE 100 frequently pay high dividends. These stocks provide retirees with passive income and will almost certainly increase their dividends over time, ensuring that you will never have to worry about outpacing inflation.

- The yield is usually between 4% and 6% each year.

- Invest through a Stocks and Shares ISA for the tax-free income and look into high-yield stocks with solid finances.

Buy to Let Property Investments (BTL)

Purchasing property to rent out is still one of the best investments for retirees in the UK, with a consistent income stream and potential growth in capital over time. If the high demand for rental property in cities such as London, Manchester and Birmingham continue, retirees can secure a steady income from rental properties while watching their value appreciate.

- Average rental yield can be between 5%–7% per year and may be higher in other parts of the country.

- Property generally appreciates over time and serves as an excellent hedge against inflation.

- BTL carries a level of risk, where profits can be eaten up by property management and maintenance costs. Plus, tax changes affect landlords.

- Property can be purchased outright or via a BTL Mortgage.

Individuals who do not want the risk exposure may consider Real Estate investment through REITs (Real Estate Investment Trusts). Investing in property companies without physical ownership.High-Yield Corporate Bonds

It’s predictability makes corporate bonds an ideal instrument for retirees, and one of the best investments for retirees looking to minimize risk. Some Companies offer high-yield bonds, paying periodic interest, which is generally higher than what is paid for bonds issued by a government’s bonds.

- Annual returns can be 4%–8% per year.

- Investments in bonds generate fixed income, which is a good fit for retirees who need steady income.

- Inflation can eat into real returns, plus the risks of company defaults.

Investment can be through Individual bonds or bond ETFs like the iShares UK Corporate Bond Index Fund. For tax relief, hold bonds in a Self-Invested Personal Pension (SIPP). You may also spread bonds between sectors.

Investment Trusts & Fund – Investment Infrastructure

Funds that invest in UK infrastructure projects, are a good investment because they offer a stable, government-backed source of income. Infrastructure investments are generally in essential services like roads, hospitals and utilities – which means there is always demand.

- The yield for this kind of investment is 4%–6% annually.

- Infrastructure assets are linked to inflation, serving as a hedge against rising expenses.

- Some projects could face delays or cost overruns.

- There are online platforms available for this kind of Investment.

Look for funds which offer inflation-adjusted returns.

UK Equity Income Funds

If you prefer a hands-off approach to investing, you can always invest in one of the many UK equity income funds which hold a portfolio of dividend-paying stocks. UK Equity Income Fund concentrate on blue-chip shares with a history of smart dividends.

This carries lower yields of 3.5%–5% per year compared to other investment options.

It produces a steady income as funds are professionally managed. However, fees on the funds can nibble away at gains and stock market swings affect performance.

For tax efficiency, select funds in an ISA or pension. Carry out a proper research on fund performance before investing. Use investment platforms.

Peer-to-Peer Lending (P2P)

Retirees can lend money to businesses or individuals on P2P lending platforms for attractive interest rates. However, P2P lending (while not free of risk) can offer better returns than standard savings accounts.

- Average Yield is 5%–8% a year.

- It carries higher returns than fixed-rate bonds or savings accounts.

- Risks level can be high if borrowers default, it can affect returns and liquidity is low.

- Diversification: Spread your lending between a variety of borrowers to mitigate risk.

- Opt for platforms that have solid credit checks and protections.

Stabilise loan performance through periodic monitoring.

Annuities for A Steady Stream of Income

If you seek guaranteed income for life, annuities are still among the best investments for retirees who value security. UK retirees can purchase an annuity using their pension pot to receive a guaranteed income for life.

- Yield is on the average of between 4%–6% per year

- Offers a predictable income and peace of mind.

- Inflation can eat away at purchasing power, unless you select an inflation-linked annuity.

- Compare rates on the MoneyHelper Annuity Comparison Tool before investing.

- Consider partial annuitisation for flexibility.

Emerging Alternatives (Commodities, Gold, and Green Energy)

Retirees can invest in commodities such as gold, silver and renewable energy funds that provide them diversification and a hedge against inflation.

- The average Yield is contextual, depending on prevailing market conditions.

- It offers portfolio diversification and helps to hedge against economic downturns.

- Prices are volatile and may not yield expected passive income.

- Invest in gold, gold ETFs or green energy funds.

Watch out for commodity price trends before you invest.

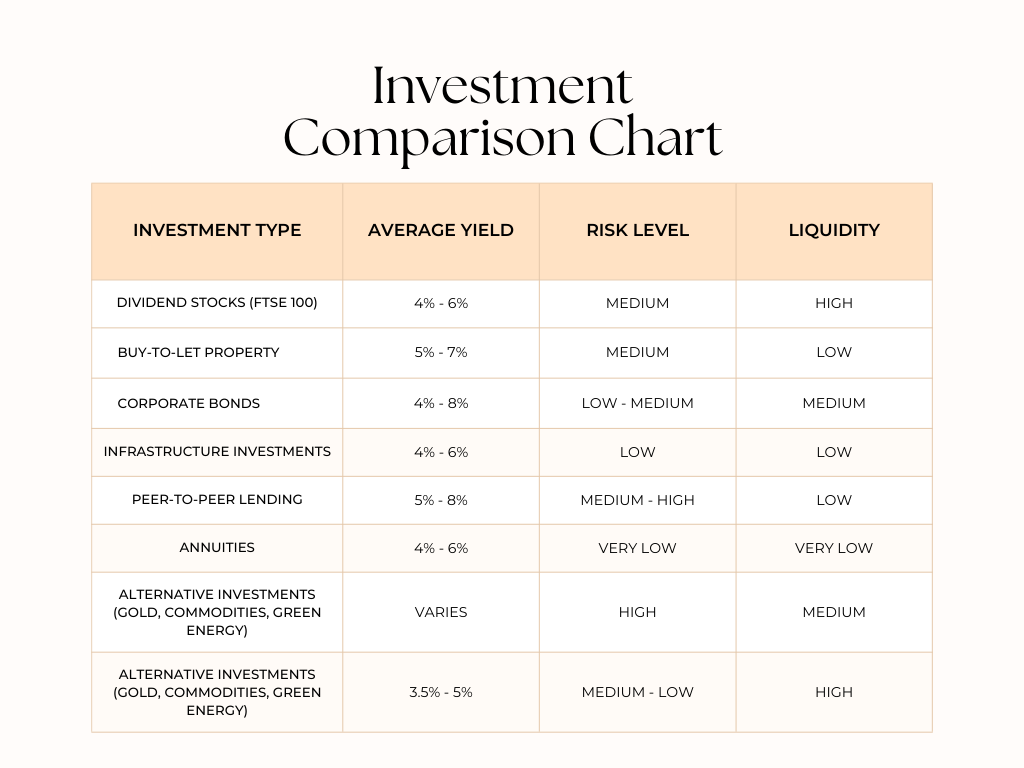

Investment Breakdown Chart

See the chart below for the breakdown of each investment type, including average yield, risk level, and liquidity to help you make an informed decision.Investment Breakdown Chart

Actively Monitor Your Investments

While retirement investments should not be a “set and forget” strategy. Regular evaluations help maintain alignment between your portfolio, financial goals, and risk appetite.

Consult a Financial Advisor

While this guide provides an introduction, however it is always advisable to talk to a professional financial advisor before making any significant investments. A financial adviser can evaluate your specific situation and help you build a retirement portfolio that supports your long-term goals.

Stay Updated! For insights on creating a retirement budget without compromising on happiness, check out our article here.

Follow us for more insights on how to achieve financial independence in retirement!

Sources:

1. London Stock Exchange

2. Zoopla Rental Yield Data

3. Morningstar UK Bond Market